Pump-and-dump scheme: the age-old game - making the rich richer

In the classic "pump-and-dump scheme", the forced decline on the markets leads to the masses selling cheaply out of panic. Investors who have sufficient liquid funds (cash) then have the opportunity to buy during these low phases - a mechanism that leads to a massive redistribution of values and wealth. A broad empirical analysis shows that the liquidity forces of top earners and institutional investors are often decisive in times of crisis.

The coronavirus crisis as an example of extreme redistribution

The recent global economic crisis, triggered by the coronavirus pandemic, is a good example of how political and economic shocks can exacerbate existing inequalities. While companies were able to record enormous profits on the capital markets in some cases, the wealth of the richest 10% increased by up to 50% in some regions, while broad sections of the population suffered income losses and job insecurity at the same time. This development can be backed up by figures: according to Oxfam's “Time to Care” report, the wealth of the top 10% in many industrialized countries grew by 40-50% during the crisis, while wealth accumulation in the lower income brackets largely stagnated or even declined. This dynamic makes it clear that during economic downturns, the main beneficiaries are those who have sufficient equity and are prepared to take advantage of market lows.

The road to redistribution: from crisis to enriching the elites

Historically, it is well known that totalitarian regimes and authoritarian systems use crises as a tool for redistribution. In times of total economic hardship, comparable to the decline during extreme crises, the impoverishment of broad sections of the population and the disruption of the real economy often leads to social upheaval (reminiscent of the rise of the Third Reich).

Statistics show that in the hardest economic phases, when real income fell by up to 30-40%, massive shifts in wealth were often recorded as a result. These phases often went hand in hand with the acceptance of restrictions on democratic processes, as broad sections of the population lost confidence in the established systems in times of massive economic hardship. The resulting willingness to accept authoritarian measures was reinforced by targeted economic policy measures and emergency programmes that served under the guise of stabilization - and in reality served to concentrate capital. If, in the worst-case scenario, Trump really is intent on turning America into a despotism under his leadership, it would make sense to bankrupt the economy at home.

Mar-a-Lago Accord: A controversial redistribution plan

The so-called “Mar-a-Lago Accord” is a plan proposed by the nationalist conservative Heritage Foundation, which was published in mid-2024. According to internal information, the main author - Robert K. Miller - whose name is now associated with Trump's leadership team, was heavily involved in the design. Many elements of the current plan correspond almost 1:1 to the paper originally published by the Heritage Foundation. For example, one section of the plan explicitly calls for: “The conversion of short-term US government bonds into long-term instruments should enable the USA to drastically reduce its interest burden - a concept that was already described in detail in the 2022 submission.” Another example is the description of the readjustment of trade deficits, which uses exactly the same logic as in the Heritage Foundation paper: tariffs are calculated in such a way that they virtually “neutralize” the existing trade deficit. These similarities indicate that the current political course is strongly oriented towards the think tank's guidelines.

Drastic tariffs and the sovereign debt crisis

The Trump administration is using drastic tariffs as a bargaining chip. The aim of this measure is to “neutralize” the bilateral trade deficit. In concrete terms, this means that the interest rate is calculated in such a way that the value of the respective deficit is brought back to zero. This may appear to be a simple economic instrument, but in practice it has far-reaching consequences.

One of the USA's central problems is its enormous national debt. As a result, a considerable proportion of the state budget - often over 20-25% - has to be spent on servicing debt and interest payments every year. This significantly reduces the scope for investment in infrastructure, education and social programs and also makes the USA dependent on foreign investors. In order to reduce this dependency, Trump has called for external holders of 10-year US government bonds in particular, above all China, to convert them into 100-year bonds - and forgo regular interest payments in the process. In concrete terms, such a switch would mean that an investor who could previously expect an annual return of around USD 25 million on an investment of USD 1 billion at an interest rate of 2.5% would practically forgo this return if they converted. The aim behind this is clear: the USA is to be effectively relieved of parts of its debt burden, which can ultimately be interpreted as a form of debt relief.

Another element of the plan is military pressure: in future, NATO's protection will only be guaranteed to countries that are prepared to devalue or cancel US national debt in some form. The offer is summarized as follows: “We will lower the punitive tariffs and continue to provide you with military assistance if you support us in reducing our debt in return.” This is clearly reminiscent of the mafia method of protection racket: "If you make me an offer I can't refuse, I'll waive the punitive tariffs and continue to offer you military protection.

Outlook: Two possible scenarios

First: The plan works. The dollar is devalued, interest rates fall and the USA can ease its debt problems. At the same time, the income generated abroad in foreign currency by American companies gains in relative purchasing power. This leads to a revival of the markets - share prices, particularly of American stocks, climb back towards their previous highs.

Alternatively, the countries affected do not participate. Instead, they impose their own counter-tariffs and refuse to convert their US government bonds into long-dated bonds. In this case, the USA becomes increasingly isolated, while international trade - apart from the USA - continues unhindered. This would be so catastrophic for the US economy that it can be assumed that forces within the US would then emerge that would persuade the Trump government to rethink or even replace it. Historical examples show that economic isolation usually leads to internal upheaval, which is often followed by a market and economic recovery.

The question of cooperation with Russia

Trump's original plan to achieve peace between Russia and Ukraine at the beginning of his term of office proved impossible to implement. Unfortunately, Trump's revered Putin is not willing to make any commitments or concessions to end the war. As Trump's negotiating successes in this area failed to materialize, the originally planned approach (presumably a kind of division of Ukraine between Russia and the USA: Russia keeps the occupied territories and the USA gets access to the rare earths) is likely to be discarded once and for all.

This leaves him with the alternative of continuing to support Ukraine against Russia or, even better, making the EU responsible. Such a strategy would result in the USA being able to significantly improve its position in this sector, which would contribute to the announced rise of the USA. Russia would gradually run out of steam and the conflict would slowly come to an end. As a result, the stock markets would recover and move significantly higher.

Market forecast and the role of the cost-average model

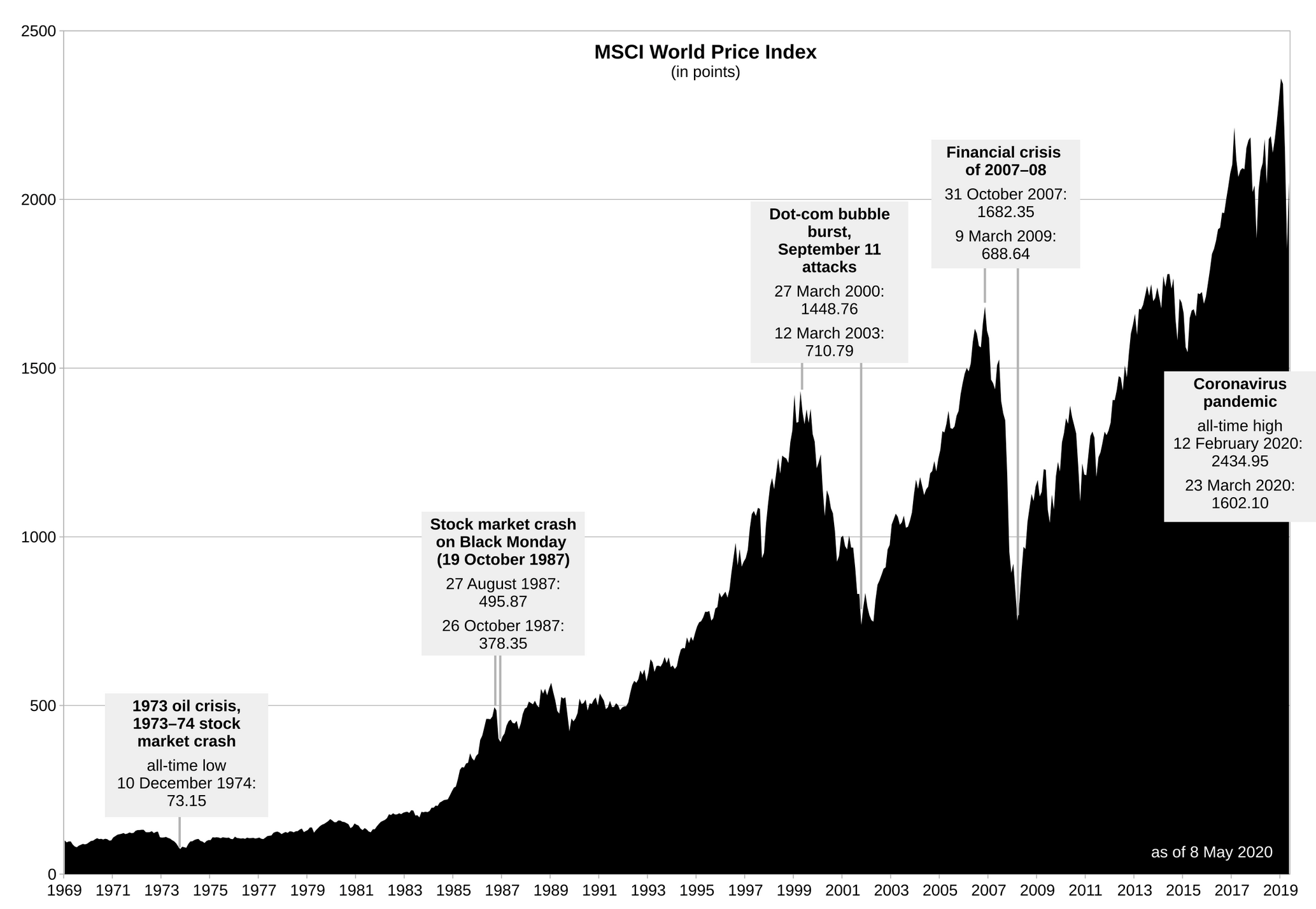

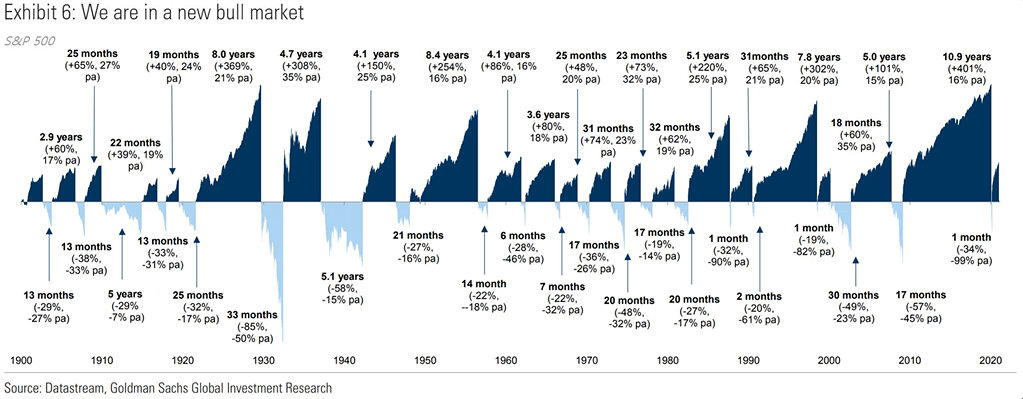

From an investor's perspective, the key question now is: how long will the downturn last and how much further can prices fall? Since the peak at the end of last year, the markets have fallen by an impressive 30-40%, depending on the index. However, it must be borne in mind that the euphoria at the start of a Trump administration caused the markets to rise by over 50% in some cases. If one compares the current level with the unrealistically high starting level, the actual loss appears much more moderate.

This underlines the value of the cost-average model: instead of making the entire investment at once, you spread your payments over regular tranches (e.g. monthly) and thus automatically take new lows when prices continue to fall and then profit from them when the market turns.

Added value of Wavealert

Our tool Wavealert offers a decisive advantage in order not to lose the overview in such volatile times. Wavealert enables investors to monitor the market and individual stocks in real time. The system provides automated news and alerts when certain thresholds are reached, such as a sudden price drop of more than 20% in a few days or weeks. These precise notifications allow investors to invest in a tactically prudent and staggered manner, which further supports the success of the cost-average approach. Ultimately, Wavealert helps to minimize risk and identify opportunities in a targeted manner - especially in phases where quick reactions can make the difference between success and failure.

Conclusion

The analysis shows that, historically, political intervention and protectionist measures have repeatedly led to significant crises and far-reaching redistributions. At a time when crises such as the coronavirus pandemic have led to an increase in wealth inequality, investors need to act wisely. Whether you sit out the crisis or make targeted, staggered investments with liquidity - both strategies will lead to success as soon as the markets recover. Supported by modern tools such as wavealert, investors also maintain an overview and can react to market changes in good time. Ultimately, even if short-term slumps seem frightening, they offer long-term opportunities to buy - and to profit from the subsequent upswing.

Sources

- Wikipedia MSCI-World

- Wikipedia: List of Stock Market Crashes

- U.S. COVID-19 Stimulus and Relief

- Trade War: Déjà-vu with Trump

- YouTube: Trump & Musk Secret Plan to Crash Economy to Make Billions

- LBBW: Mar-a-Lago Accord

- Frankfurter Rundschau: Trump's “mafia methods” from Mar-a-Lago - dubious plans for European trade